[ad_1]

In early March, Rishi Sunak introduced his 2022 Spring Finances designed to assist ease the price of dwelling throughout the UK and assist kerb to ever rising charge of inflation throughout the British economic system. Now after a number of weeks we have now been capable of digest and comprehend what his funds truly means for almost all of the UK.

As 2022 rounds out its first quarter, it has develop into very clear from all media sources that inflation is continuous to rise. This started as we re-emerged from the COVID-19 pandemic. Through the nationwide lockdowns, factories the world over have been shut however demand grew. Individuals additionally saved their money moderately than spent it as a result of ongoing uncertainties throughout 2020 and in to 2021. Not solely have been factories shut however the places of work used to course of orders and run the executive facet of companies have been furloughed.

Lot of companies, in each sector, couldn’t present the merchandise desired by their clients. The state of affairs was additional exacerbated when a reported 1.2 million individuals left the employment market. Most of those individuals retired, having seen the writing on the wall and predicated that post-pandemic they wouldn’t be wanted.

Now we’re in a situation have been there aren’t sufficient employees to supply the providers we want. Brexit added one other complication because the UK couldn’t simply import a mass of low-cost labour from the European Union.

Quantitative Easing by the Financial institution of England

In November 2020 the Financial institution of England started one other section of quantitative easing (the bogus printing of cash) – this time to the tune of £150bn ($198bn on the time). This was completed in an effort to (efficiently) stave off a melancholy, serving to forestall a ‘double-dip recession’.

It now appears to be having the alternative impact, with inflation at the moment sat at simply over 6%. The Financial institution of England predicts inflation to hit 8% by the tip of spring and will swell even larger later within the yr. That is very important, as which means inflation will likely be at its highest for the reason that 1980’s. So as to add insult to harm, the UK is shifting right into a interval the place dwelling requirements are going to scale back by the identical ranges it noticed within the 1950’s.

Geo-political issues in Europe

The continued points with the Russian invasion of the Ukraine and the sky rocketing price of vitality payments have left the UK economic system, in addition to tens of millions of households, on a precipice.

In these troublesome occasions Chancellor of the Exchequer, Rishi Sunak, has repeatedly informed the UK that he’s a prudent chancellor. He retains informing most people that he’s a beneficiant chancellor, one which likes to supply for us.

The 2022 Spring Finances

In late March, the Spring funds was introduced and in brief, it doesn’t add as much as a lot. The figures offered in entrance of Parliament might sound spectacular at first look, however additional investigations reveals that they’re actually a drop within the ocean of what they wanted to be.

Rising gasoline prices

The UK is at the moment witnessing petrol costs within the £1.60’s a litre while diesel is rubbing £1.90 a litre. A part of this enhance comes through Russia’s invasion of Ukraine. Based on Downing Road, the UK will get about 8% of its general oil provides from Russia, which equals round 18% of our diesel. This isn’t as dangerous because the EU, who depend on Russia for practically a 3rd of their oil.

Diesel itself is extraordinarily essential to the UK economic system. Not solely does it energy round 30% of all UK vehicles, it additionally powers vans, buses and a few trains. Diesel can also be utilized in farming and agricultural tools (because the well-known purple diesel).

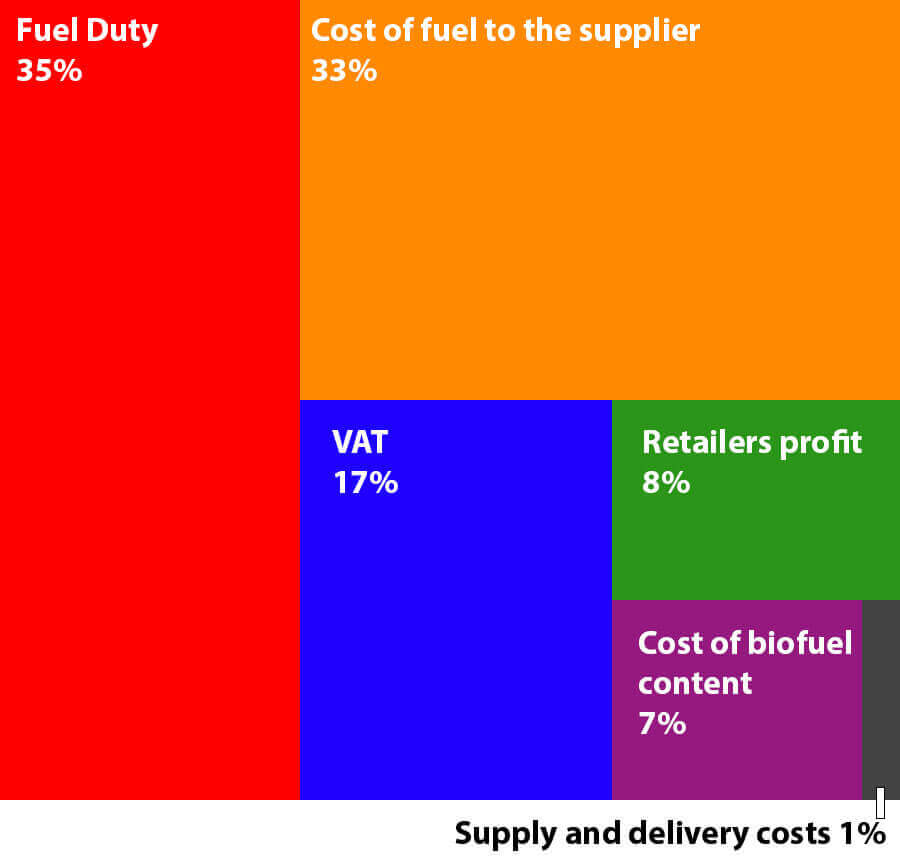

So as the fight the seemingly steady climb of gasoline costs, Sunak introduced a 5p per litre discount in gasoline obligation. Within the UK gasoline obligation makes up 35p in each £1 you spend on gasoline. As of 6pm on 23rd March 2022, this dropped to 30p in each £1 spent. This discount will final one yr till the next March.

So how a lot does this profit the UK motorist? On a median £90 refill, the chancellors gasoline obligation lower will prevent round £3. As of late March / early April the pumps have solely seen a median discount of two.7p per litre. We’ll give the forecourts the good thing about the doubt till later within the yr to see in the event that they move on this lower to the patron or use it for profiteering.

Sunak’s huge thanks to the UK motorist appears extra like a hole gesture to tick a field, moderately than present some significant aid.

Skyrocketing vitality gasoline costs

Subsequent up we have now the rising price of vitality. One thing that has seen costs go supernova in latest months. The state of affairs turned so dire that in 2021 some 4.3million clients misplaced their provider to price points. The majority of this downside is sourced from wholesale fuel costs. As of April 1st 2022, 22 million households suffered one other crippling blow to their funds.

OFGEM, the UK authorities regulator for fuel and electrical, elevated the vitality value cap by a staggering 54%. This enhance solely impacts individuals on customary charge tariffs. The brand new value cap, which is able to final till 30th September 2022, sees each vitality prices and standing expenses enhance.

- Electrical will enhance from £0.21 per kWh to £0.28 per kWh. The standing cost for electrical will even enhance by a staggering £0.20 to £0.45 per day.

- Fuel costs will enhance from £0.04 per kWh to £0.07 per kWh. The fuel standing cost will enhance by 1p to £0.27 per day

On common this can enhance yearly cost by £693 for account paid through direct debit. Pre-paid accounts will see a median enhance of £708.

The scary a part of the OFGEM enhance, is that it solely lasts till the Autumn when costs are anticipated to develop but once more. This time by one other 30%. What did the 2022 Spring funds do for the vitality disaster?

Sadly, the reply is once more not a lot. Based on latest analysis, 40% of properties with youngsters at the moment are in gasoline poverty. 40%.

25% of all properties at the moment are classed as being in gasoline poverty, that’s 1 in each 4 properties.

What’s gasoline poverty?

Gas poverty, in essence, is when a family spends greater than 10% of their revenue on gasoline. Based on British fuel, the common 2 grownup 2 youngsters dwelling makes use of about £1970 price of fuel and electrical yearly. This implies you would want a take dwelling wage of £19,700 simply to not be classed as being for gasoline poverty.

Tackling the rising prices of vitality within the 2022 Spring Finances

Council tax rebates and curiosity free loans

Households in council tax bands A-D will likely be given a £150 rebate on their council tax. This cost ought to start in April for homes who pay through direct debit. For later within the yr the chancellor introduced a £200 curiosity free mortgage for households to make use of for rising vitality prices.

This mortgage will likely be curiosity free and paid again over 5 years beginning in 2023. With common vitality costs rising by practically £700, Sunak has supplied the UK taxpayer assist of round 50%. Whenever you issue within the skyrocketing inflation and gasoline costs, his measures do little or no to assist. Additionally, the mortgage means as costs proceed to extend, households will even need to make repayments to the federal government.

Scrapping VAT on vitality saving merchandise

One other of Sunak’s plans is the elimination of the 5% VAT on vitality effectivity supplies corresponding to photo voltaic panels, warmth pumps and insulation.

That is yet one more hole transfer by the chancellor. The common price of a easy 4kW photo voltaic panel arrange is knocking on the door of £5000. The elimination of the VAT brings this price all the way down to round £4750. At a time when households are struggling to warmth their properties or feed their youngsters, a 5% low cost on £5000 appears out of contact.

Sunak championed this plan by saying it was solely doable due to Brexit. This isn’t true, as in early March 2022 the EU accepted plans for all its member states to exempt merchandise, corresponding to vitality financial savings supplies, from VAT.

Sunak’s energy punching insurance policies for Nationwide Insurance coverage and Earnings tax

Now we transfer on to the primary energy punches of Sunak 2022 Spring funds. The chancellor introduced a rise within the threshold at which individuals will begin paying Nationwide Insurance coverage. The revenue tax threshold is £12,570, however Nationwide Insurance coverage was sat at £9600.

In an surprising transfer, Sunak raised the Nationwide Insurance coverage threshold to match revenue tax. This blindsided most individuals, even different MPs, as they anticipated only a £1000 enhance, at greatest. The brand new threshold means a median tax lower of round £330. This tax lower gained’t begin till July 2022. The edge enhance will barely compensate for the rising rise in inflation however once more, doesn’t go far sufficient to learn individuals.

The “greatest” was but to return. Sunak proudly introduced that he will likely be decreasing revenue tax from 20% all the way down to 19%. The draw back (as all the time) was that this pledge was made with no outlined date. Sunak solely mentioned he would achieve this earlier than the Conservative authorities was up for re-election. Most famous this was merely a transfer saved within the chancellor’s pocket to win voters on the subsequent normal election.

What in regards to the UK property market?

The place does the 2022 Spring Finances depart the UK property market?

First time consumers are questioning, and worrying, how they’ll afford to save for a deposit. Their spending energy has been hacked down by the price of dwelling disaster. Based on the Workplace for Finances Duty (OBR), the proportion of revenue that’ll be saved goes to fall, drastically. All through the pandemic, households have been sometimes capable of save 10% or extra of their wage.

All through 2022 and in to 2023 that is anticipated to plummet to only 3.1%. The one silver lining is that, in response to the OBR, runaway home costs are starting to gradual. Forecasts predict UK home costs will enhance by 7.4% in 2022 however simply 1.3% in 2023. Then throughout 2024, 2025 and 2026 homes will enhance by 1.5%, 2.5% and three.1% respectively.

In conclusion, how efficient will the 2022 UK Spring Finances be?

Not very. Sunak has performed his card of telling everybody how a lot he cares with none substantial again up. His tax cuts and rebates supply the common dwelling spherical £700. The Spring vitality gasoline rises wipes this out virtually immediately. Shifting in the direction of the Autumn households are anticipated to battle in method we haven’t seen as a rustic in practically 70 years.

Greater than 1 in 5 individuals are at the moment in poverty, a quantity that can solely develop with these price will increase. Its time to batten down the hatches and put together for some tough seas forward.

Have a query or want to discover out extra? Then merely get in contact with us in the present day and a member of the staff will likely be available to assist.

[ad_2]