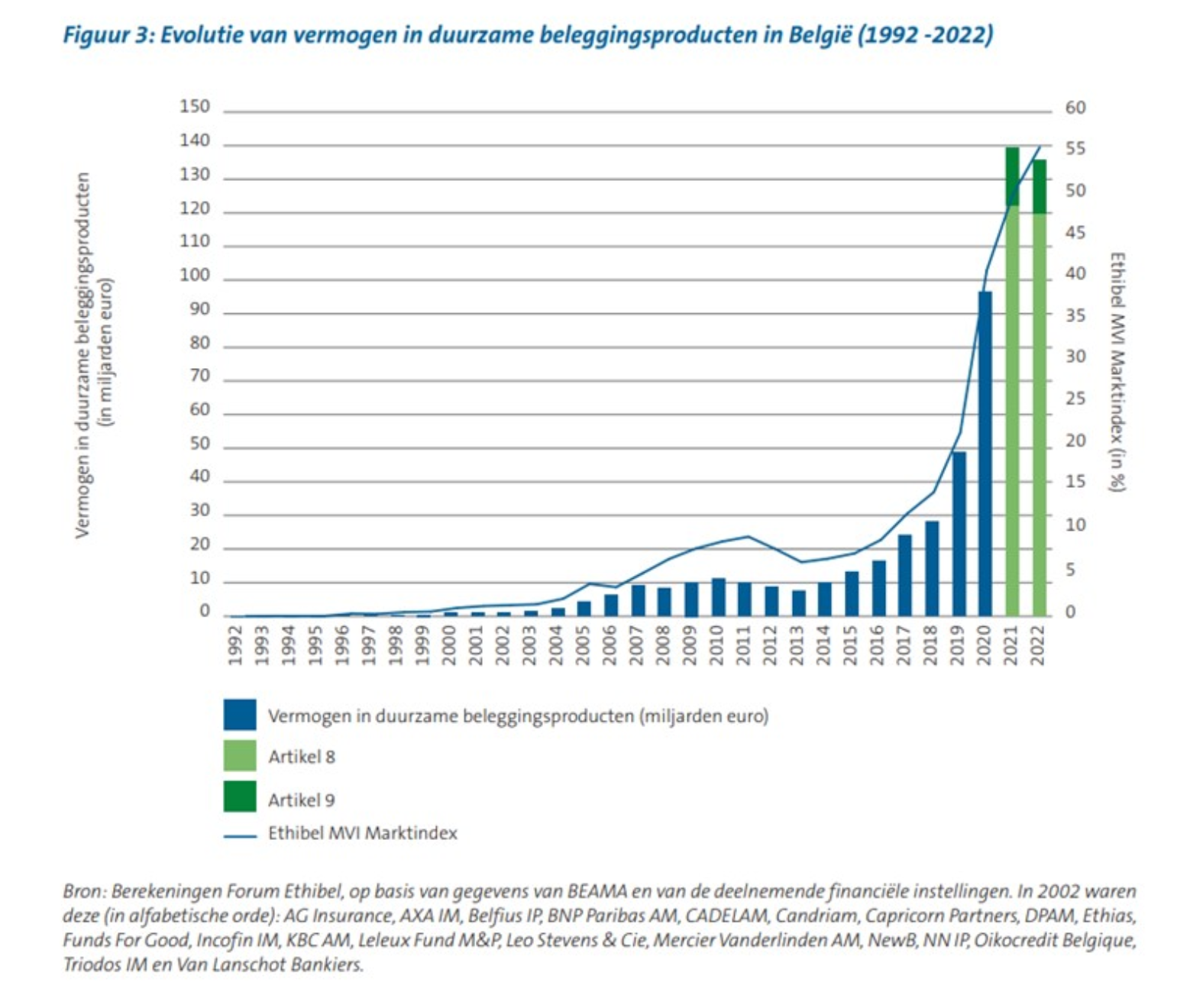

Forum Ethibel has published the 2023 ERSIS study (Ethibel Research on Sustainable Investments and Savings). This study takes a look at the current situation and trends in sustainable savings and investments in Belgium. Forum Ethibel promotes sustainability in organizations and financial markets and is the official verifier of the Belgian Towards Sustainability Label. The year 2022 showed a decrease in the total volume of sustainable investments by 2.5%. This is new, as a continuous increase has been observed since 2013. On the other hand, the number of sustainable products on the Belgian market has increased by 8%.

This study is the result of a collaboration between Forum Ethibel, the Federal Institute for Sustainable Development (FIDO), the University of Antwerp and various players from the financial sector. The aim is to highlight the importance of sustainability in the Belgian financial world.

Conclusions

If we look at sustainable investing, it is striking that the ratio between the sustainably invested volume and the general invested volume increased in Belgium. However, we see a decrease in the total volume of sustainable investments by 2.5%. This is new, as we have observed a continuous increase since 2013. On the other hand, the number of sustainable products on the Belgian market has increased by 8%. Providers of sustainable products still see sufficient potential. In our country, the Towards Sustainability label, among other things, appears to be an incentive – especially for foreign players – to launch extra sustainable products or make existing products more sustainable.

The evolution of sustainable saving also deserves nuance. There we will see an increase of 5.3% in 2022, or an increase of €130 million in sustainable savings. Although they still come from the same players. Moreover, our 2022 figures include NewB bank’s volumes for completeness and accuracy. We now know that this bank was unable to raise sufficient fresh capital from its co-operators and investors. As a result, NewB had to surrender its banking license in 2023. Although a solution was found for savers in collaboration with vdk bank, many are left with the feeling that sustainable banking may not be so feasible after all.

And then the (complex) regulations. On the one hand, we see a positive stimulus from the European Green Deal, which focuses, among other things, on the financial sector. More clarity and transparency are expected about the sustainable character of a financial product. The categories Article 8 and Article 9 often serve as a guideline for comparing products. At the same time, since 2022, investment advisors have been obliged to ask investors about their sustainability preferences. Gauging to what extent someone wants to make sustainable financial choices is a very useful idea. But answering the question in a few minutes to what extent you want to invest in a taxonomy-aligned manner or how important Principle Adverse Impact is is not an easy task for most private investors. No matter how hard investment advisors try, this framework can be improved.

There is good news to report in the field of impact investing. With impact as a focus, you want to invest with the intention of generating a measurable impact on society and the environment in addition to financial returns. Since Impact Finance Belgium (IFB) was launched in 2022, there has been a lot of networking going on. The various actors, together with IFB, want to harmonize the sector and make it more transparent. Even though impact investing currently only accounts for 0.5% of the European investment market and around 1% of the Belgian investment market, there is potential. ESG integration also started in small steps. A simple look at our Ethibel market index since 1992 clearly shows this.