Changed income, corporate, gift and transfer tax brackets and rates will apply for next year.

Update 22-09-2023, 10:00 am: During the General Deliberations of September 21, the House of Representatives decided to increase the top rate in box 2 from 31 percent to 33 percent. The box 3 rate increases from 34 to 36 percent. These new percentages have not been included in the relevant tables.

Income tax

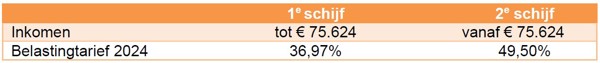

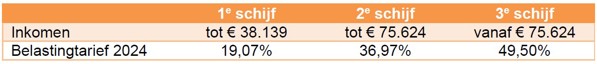

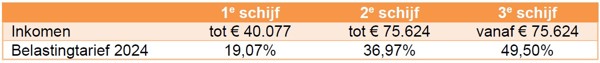

Box 1: Bands and rates

In 2024, the rate of the lowest tax bracket will increase slightly to 36.97%. From 2024, the tax brackets and rates for box 1 will be as follows:

Not entitled to AOW

Entitled to state pension and born after 12/31/1945

Entitled to state pension and born before 1-1-1946

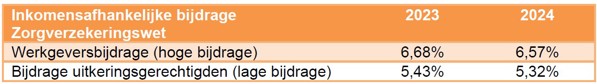

The income-related Health Insurance Act contribution will decrease by 0.11% next year. This applies to both the employer contribution and the contribution that benefit recipients, among others, owe on their pension, standing right and annuity benefits.

Box 1: Rate correction

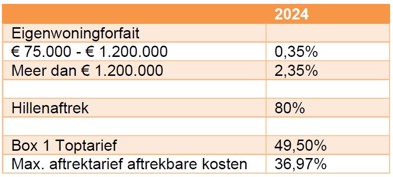

Deductible costs can be deducted in 2024 at a rate of up to 49.50%. Consider, for example, the annuity deduction. However, many deductible items are subject to the so-called rate correction, which means that they can be deducted in 2024 at a rate of up to 36.97%.

If a taxpayer’s income is taxed in the highest income tax bracket (49.50% in 2023 and 2024), deductible costs are also taken into account at this rate. Consider, for example, annuity deduction. Important exceptions have been made to this general rule. For example, for the deductible costs of the owner-occupied home, such as home acquisition interest, ground rents and the mediation invoice from the mortgage advisor. These costs are taken into account at a maximum rate of 36.97% (2024). This is therefore 12.53% lower than the maximum tax at which the income from the owner-occupied home – in particular the notional rental value – is taxed.

The overview below shows the development of the rate correction up to and including 2024.![]()

The rate correction applies not only to the deductible costs of the owner-occupied home, but also to the following deductible items:

- entrepreneur deduction;

- SME profit exemption;

- provision exemption;

- deduction of maintenance obligations (alimony);

- deduction of expenses for specific healthcare costs and weekend expenses for the disabled;

- deduction of training expenses;

- donation deduction;

- remainder of personal deduction from previous years;

- losses on venture capital investments.

Box 1: Your own home in 2024

Next year, the home ownership scheme will change on several points. The rate at which, among other things, mortgage interest can be deducted will be 36.97% in 2024. The previously introduced restriction on the Hillen deduction will be continued.

Box 1: Phasing out of self-employed persons’ deduction

The self-employed person’s deduction – in fact a tax incentive to stimulate entrepreneurship – is being phased out gradually.

Importance for practice

There is a lot of bogus self-employment in the Netherlands. That must be combated. This is one of the measures to reduce bogus self-employment. This reduces the difference in tax treatment between employees and the self-employed. The acceleration of the phasing out of the self-employed person’s deduction will be offset by an increase in the employed person’s tax credit during the cabinet’s term of office. Self-employed people and employees benefit from this.

With effect from 1 January 2024, the percentage of the SME profit exemption will be reduced from 14% to 12.7%. The starters deduction will remain unchanged in 2024 at €2,123.

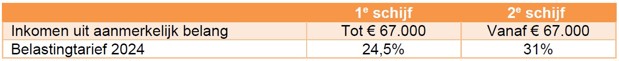

Box 2: Rates

In 2024, two brackets will be introduced in box 2 with a basic rate of 24.5% for the first €67,000 (2024) of income and a rate of 31% for the excess. With this measure, the government aims to encourage managing directors to have part of their BV’s profits distributed annually in the form of dividends in order to limit tax deferrals.

NB: During the General Deliberations of September 21, the House of Representatives decided to increase the top rate (2nd bracket) in box 2 from 31 percent to 33 percent. This new percentage has not been included in the table above.

Box 3: Rates

The income tax rate on the income in box 3 will change next year. The change is included in the table below.

NB: During the General Deliberations of September 21, the House of Representatives decided to increase the box 3 rate from 34 to 36 percent. This new percentage has not been included in the table above.

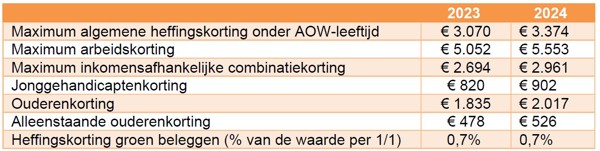

Box-transcending: Tax credits

In 2024, tax credits will increase across the board. Tax credits are discounts on the income tax and national insurance contributions payable. The 2024 Tax Plan includes a substantial increase in tax credits. This measure is in line with the government’s aim to combat poverty, maintain purchasing power and make work more rewarding.

Below is an overview of the tax credits for 2023-2024.

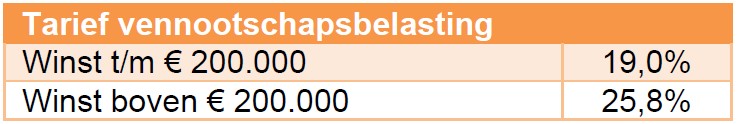

Corporation tax

Bands and rates

The bracket limit for corporate tax in 2024 (as in 2023) is € 200,000. As a result, companies are more likely to pay the high rate of the second bracket. The rates remain unchanged compared to 2023.

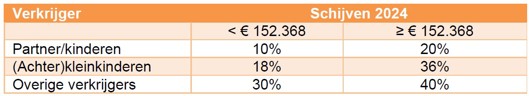

Inheritance and gift tax

Bands and rates

The inheritance and gift tax rate will remain unchanged in 2024. The disc length has been adjusted.

The one-off increased donation exemption in connection with the owner-occupied home (€ 28,947 in 2023) will definitively expire in 2024.

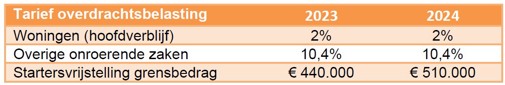

Transfer tax

prices

The transfer tax rates remain unchanged. The limit amount of the starter’s exemption will be increased.

State pension age in 2024

In 2024, the state pension age will be increased by two months to 67 years. In 2019, it was agreed in the Pension Agreement that the state pension age would increase less rapidly. Until then, the state pension age increased 1:1 with life expectancy. The law now stipulates that for every 4.5 months that Dutch people are expected to live longer, the state pension age automatically increases by 3 months. This is done on the basis of the annual CBS forecast for the remaining life expectancy of 65-year-olds.

The state pension age will remain at 67 for the years 2024 to 2027. The state pension age is relevant, among other things, for the earliest and latest commencement date of pension, annuities and golden handshake rights.

Source: Legal & Tax Nationale Nederlanden

38009