Investing in ESG has quickly made a name for itself as an important strategy for sustainable investing. According to the Global Sustainable Investment Alliance, ESG-related assets now account for a third of global investments. This growth shows that people are concerned about climate change and social issues.

In private equity, ESG means that you take into account factors such as energy, climate, raw materials, health, safety and good governance. This is taken into account when choosing shareholdings in companies.

But despite the strong increase, investing in ESG does not immediately mean investing in solutions for a better world. These investments will not solve the environmental and social challenges that lie ahead.

Not the impact, but the financial opportunities

Why not? Current ESG ratings do not measure a company’s impact on our planet and society. They do measure the financial opportunity of an investment by taking into account the impact that environmental, social and governance conditions can have on a company’s profits, losses and shareholders.

In other words, ESG investing protects assets against the effects of climate change, for example, but does not necessarily help solve climate change. The risks that could have a negative impact on a company’s future financial performance are therefore leading. Things like carbon emissions are only included in a company’s ESG scores based on their expected impact on future returns.

ESG ratings focus mainly on policy and how transparent a company is about it, less on the emissions of products themselves. When they do look at the products, they compare them with the sector in which they operate.

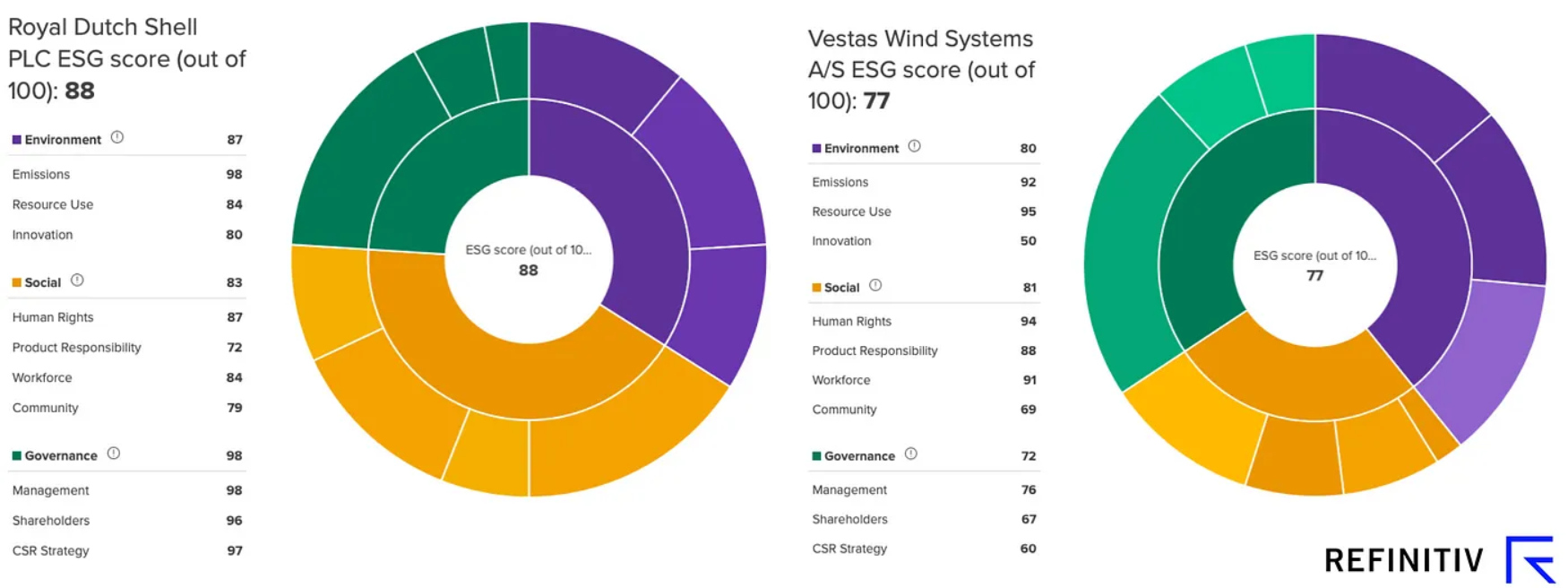

This is partly why oil and gas companies score well on ESG. As shown in the image below, Royal Dutch Shell has a higher ESG score than Vestas, a wind turbine company that actually helps reduce CO2 emissions.

How did that happen? Shell and Vestas are seen as different market sectors. Shell is therefore only compared with other oil and gas companies.

Confusion about ESG investing

CEO Henry Fernandez of MSCI, which does ESG ratings, is critical of ESG investors. According to him, most individuals, many institutional investors and even some portfolio managers do not know where they are putting money when it comes to ESG.

This confusion about ESG investing is hurting the fight against climate change. Bloomberg New Energy Finance (BNEF) estimates that we need to invest between $3.1 trillion and $5.8 trillion per year through 2050 to achieve a “net-zero economy.” These investments are not included in the ESG investments that are currently being made.

In addition to financial returns, many investors also want to have a positive impact on the world. However, it is not that easy to select a sustainable fund.

According to research from The Center for Sustainable Finance and Private Wealth at the University of Zurich, there are three ways an investor can have an impact:

- Growing green businesses

- Encourage unsustainable companies to improve

- Public discussion about your investments

Points 2 and 3 are easier than point 1. You usually buy public shares on the secondary market, which means you buy someone else’s shares and not the company itself.

Startups and scaleups often depend on private capital to finance their growth and product development. By investing in private companies, investors can provide direct working capital to emerging companies trying to solve the world’s biggest challenges.

Immense challenge, but also enormous opportunities

It is difficult to comprehend how dependent humans are on fossil fuels. The energy we need, how we travel, build our homes and produce our food. CO2 emissions are involved almost everywhere.

At the same time, we must go from 50 billion tons of CO2 per year to zero in less than 30 years. To achieve this, we must reinvent our entire economy and make climate technology one of the big macroeconomic themes and growth engines of the coming decades.

The world is preparing for a net-zero future. The US Inflation Reduction Act provides at least $369 billion in green subsidies and the EU, China and Japan are also working on regulations. In the EU, almost half of large companies have plans for a climate transition. A coalition of hundreds of financial institutions has together up to $130 trillion to invest in the climate. They joined the Glasgow Financial Alliance for Net Zero in 2021.

This will drive a historically large wave of innovation. You can finance innovations needed to stop climate change and become co-owners of the net-zero economy.

Consider investments in climate technology companies such as:

Investing in groundbreaking climate solutions within private markets

Carbon Equity makes it possible for private investors to invest in climate startups. Instead of investing in a company, you invest in a portfolio of sustainable companies with professional investors through venture capital and private equity funds. This allows you to spread your investment over more than a hundred companies, across different sectors and stages.

These funds don’t just allocate capital; they use their expertise and network to grow their companies. Plus, you can make an investment in one of the biggest macroeconomic opportunities of your life.

Knowing more? read here more about Carbon Equity.

Disclaimer: Carbon Equity BV is an AIFMD-light manager and is included in the AFM register. This is a risky investment.