Robeco fund manager Arnout van Rijn describes chips in the October monthly Robeco outlook as a “standalone raw material” that is crucial for the energy transition, electric cars and smart power grids.

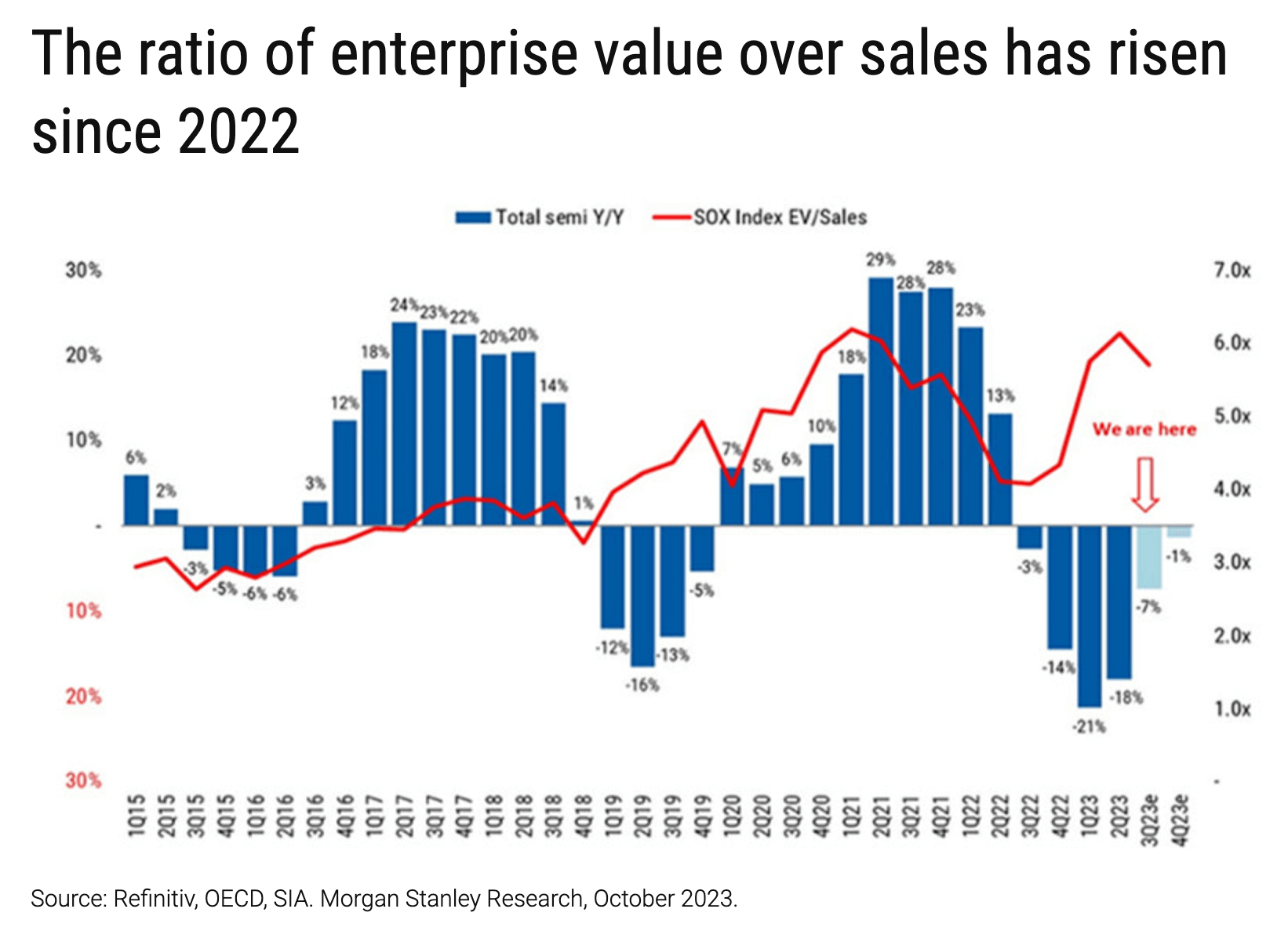

The chip market has been in a slump for some time because demand collapsed due to supply surpluses after the corona pandemic. But since the end of 2022, semiconductors have made a comeback, at least on the stock exchange, because chip prices are still under pressure.

Markets look ahead

Van Rijn thinks that next year both chip prices and exchange rates will rise. “This time last year we dared to be optimistic about the prospects for two of the most cyclical sectors: chips and ships. A quick look back shows that since then, memory chip prices have fallen further by 45% and shipping rates by 40%. But equity markets are forward-looking and chip makers are up around 30% over the past 12 months, clearly outperforming global stock indices.”

According to Van Rijn, a solid recovery in demand is in prospect for 2024, supported by a revival of the PC market, growing need for server capacity and the wave of enthusiasm about artificial intelligence (AI). The latter alone is estimated to add 5% to the global demand for computing capacity.

“Optimism about 2024 was the main driver of the equity rally in 2023, although we have seen a pullback in recent weeks due to the reversal of some coronavirus-era imbalances.”

According to him, the increase in value on the stock market is reflected in the ratio between the corporate value (market capitalization and net debt) of chip companies and their turnover. That ratio has increased considerably.

Energy transition

One of the big ones drivers the next decade is the energy transition. Semiconductors are in fact indispensable for sustainable energy. They are essential for solar panels, electric vehicles, power inverters and power storage.

Van Rijn: “They make up almost 15% of our impact-oriented equity allocation in the Multi Asset Sustainable strategy and up to 38% of Robeco’s tailor-made Smart Energy and Smart Mobility strategies.”

Strategic raw material

According to Van Rijn, chips are very similar to raw materials because prices are determined in the same way, due to the standardization of products, liquidity and global trade patterns.

But unlike mining products, semiconductors are man-made and with increased complexity and design, it is no longer a homogeneous market. “For example, anyone can make a DRAM, but only one company can make a graphics processing unit (GPU) usable for AI.”

Geopolitical dimension

Chips also have a geopolitical dimension, just like copper, cobalt or lithium. Trade wars are waged about it and enormous subsidies are given out to be or become independent from abroad. For the time being, Asia is the world market leader, but Europe and the US want to make up ground.

Van Rijn: “It is risky to leave chip production entirely to foreign parties, especially if they are located in Taiwan, an island that China claims. Politicians have only recognized this vulnerability late and have now come up with big plans to reduce dependency.”

Major investments

Europe has the European Chips Act which came into effect last month and aims to invest more than 43 billion euros, with the ambition to increase its share of global chip production from 10% to 20%.

The American one Chips and Science Act has a dual purpose. The point here is that the most advanced chips do not reach China and that so-called foundries are tempted to produce chips in the US.

This policy has already had a great effect. Of the three leading foundries in the world, Intel plans to build two factories in Germany at a cost of 30 billion euros, including 10 billion euros in subsidies. TSMC will invest $40 billion in two factories in Arizona by 2026. Samsung will invest $17 billion in an American factory, but has no plans yet in Europe.

High stock market valuations justified

According to Van Rijn, what speaks for listed chip companies is the prospect they have for future growth. The disadvantage is the high stock market valuations. But according to him, these are justified based on the strategic importance of the sector. Companies that have intellectual property earn the largest premiums.

Van Rijn: “Now that the world is changing and semiconductors are becoming a strategic raw material, we at Robeco are advocating for a futures market for memory chips. It has differentiated cycles and therefore offers great diversification benefits. It can also provide insurance against further geopolitical turmoil, just like oil used to.”