[ad_1]

That is the query many individuals are asking proper now, and the reply is determined by your circumstances. I pleasure myself on my capability to supply goal, fact-based data on the Lancaster property market so potential Lancaster home sellers, landlords, and patrons could make the most effective resolution for themselves.

My function is to coach the potential Lancaster home sellers, landlords, and patrons and to supply them with the very best data accessible, to not persuade them to do one thing they don’t need to do.

To reply that huge query within the title of the article (is now a superb time to purchase a Lancaster house?), it comes down to 3 issues.

- How a lot will you get to your Lancaster house if you promote it?

- How a lot will it’s a must to pay to your new house?

- How a lot will that transfer value you in ongoing month-to-month mortgage funds?

To reply factors 1 and a pair of accurately, I want to handle level 3, which pertains to rates of interest. The clicking-bait newspapers and web sites are pushing messages to potential sellers and patrons towards the highest finish of the sensationalised scale. I favor to outline what is going on, i.e. the truth. On the face of it, it doesn’t look good…

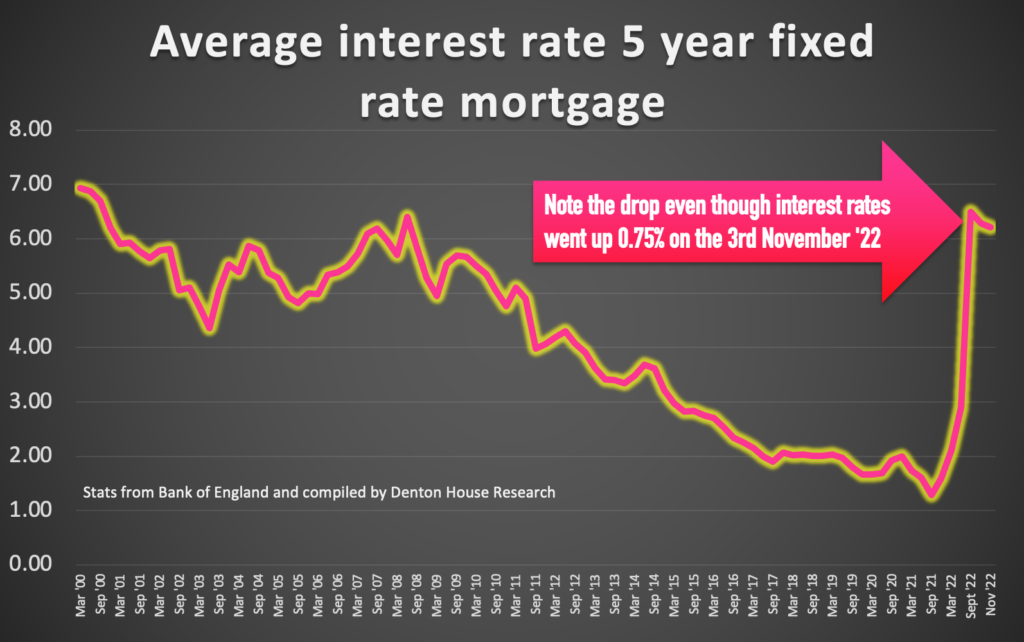

The common 5-year mounted fee mortgage has risen from 2.11% firstly of January this yr to six.21% in early November.

But though the Financial institution of England elevated the bottom fee by 0.75% on the third of November, the common 5-year mounted fee mortgage dropped by 0.22% between the third week in October and bonfire night time. As rates of interest go up, mortgage charges are coming down though rates of interest are projected to extend to 4.5% by the autumn of 2023.

So, why did the Financial institution of England point out within the first week of November that the UK is going through a two-year recession? Some would possibly assume this controversial, but many really feel the Financial institution of England desires a recession as it can help in decreasing inflation. As a substitute of relying purely on rates of interest to scale back inflation, the Financial institution of England is hoping if we go into some type of shallow recession, it won’t want to extend rates of interest a lot above the anticipated 4.5%.

Nevertheless, whether or not it’s rates of interest or a recession, each will sluggish the variety of house gross sales in Lancaster and can not directly have an effect on Lancaster home costs.

So will Lancaster home costs drop? By how a lot and what cash will it prevent in the event you wait?

It has been spoken about by many who by the top of 2023/ early 2024, Lancaster property costs are anticipated to be between 5-10% decrease than they’re as we speak. Growing mortgage charges, inflation and affordability will imply the value folks will pay for a Lancaster house will likely be curtailed due to these elements. Let’s assume a discount of 10% in Lancaster home costs.

Round 81 in 100 present householders are patrons. Once they promote their house, they virtually at all times transfer upmarket relating to lodging and placement. Therefore, they are going to pay extra for the house they purchase than the property they promote. So, if you’re in Lancaster and reside in a 2-bed home (common worth £150,100) and need to purchase a 3-bed home (common worth £214,800), the distinction between each can be £64,700.

If Lancaster home costs dropped by 10% in a few years, that £150,100 2-bed home would drop to £135,090, and that £214,800 3-bed home would drop to £193,320, which means the hole would drop to £58,230. Thus, saving the house purchaser £6,470.

So, ought to they wait?

Sure, till you have a look at the month-to-month ongoing mortgage funds. Assuming our Lancaster home-owner has an present mortgage of £100,000 and added the distinction of transferring up the property ladder to the mortgage. If our Lancaster house mover moved now, their mortgage funds can be £867.27 per 30 days (assuming a 35-year mortgage on a 5-year mounted fee at 5.34% with First Direct).

The opposite situation can be if our Lancaster purchaser waited a few years for Lancaster home costs to drop 10% (to save lots of £6,470 as talked about above) to make a transfer.

Everybody acknowledges rates of interest will rise within the subsequent two years, so the month-to-month mortgage funds once they transfer (though they’re borrowing much less) can be £1,032.02 per 30 days (primarily based on a 5-year mounted mortgage being 7.19% in 2 years).

By ready 2 years, it can value the Lancaster home-owner £164.74 further per 30 days in curiosity funds or £9,884.67 over the 5-year mortgage time period.

The purpose is that as a result of rates of interest are forecast to go increased within the subsequent couple of years, this gives potential Lancaster patrons with the prospect of locking of their month-to-month housing bills by transferring now. By shopping for now, it hedges in opposition to rising rates of interest; consequently, your month-to-month mortgage funds are going to be increased. It affords a possibility, by way of re-mortgaging, to decrease your mortgage prices ought to rates of interest fall. And there’s a stamp responsibility saving too!

What about Lancaster first-time patrons?

I learn an article on the Lancaster property market only some weeks in the past. It checked out home costs dropping by 18% in two years (as a result of in the 1988 home worth crash, the market dropped by 20% and 17% by 2008), the financial savings made on the acquisition worth had been nonetheless appreciable with the 2 further years of rental funds, the upper deposit, and better curiosity funds.

The precise disaster within the property market as we speak is the rocketing rental charges.

While a fixed-rate mortgage locks in your month-to-month housing prices, rental charges are rocketing upwards, and a tenant as we speak can realistically anticipate increased month-to-month prices within the coming few years. Although many of the press typically focuses on the financial features of shopping for a house, there are additionally decisions on homeownership that aren’t completely primarily based on monetary choices.

Why are you contemplating shopping for a Lancaster house?

Shopping for a Lancaster house could be very private and predominantly pushed by your life occasions like divorce/marriage, a job transfer, a brand new addition to the household, aged dad and mom transferring in, and so on. These are sometimes the influences that drive the choice to purchase (or not purchase) a house.

Homeownership has at all times been a basis stone of the British dream.

Homeownership affords management and a way of safety that renting merely can’t present. The doom-monger headline-grabbing newspapers typically overlook these non-economic elements affecting the need of a possible house purchaser.

The one essential factor from the previous couple of years for the reason that first lockdown in 2020 is that folks nonetheless need to personal their very own houses. They nonetheless need to have their ‘fortress’, to drag up the drawbridge when issues get robust, a spot that they and their household can name their very own. Always remember that homeownership is rather more than home costs and graphs; it’s in regards to the ‘Englishman’s house is his or her fortress dream (or Welsh / Scottish in our case).

Allow us to keep in mind most individuals within the UK have been capable of construct and develop their household wealth by way of homeownership. That’s the reason I like to supply the most effective data on the Lancaster property market so you can also make the most effective resolution for your self and your loved ones.

Please drop me a line in the event you want to choose my mind on something mentioned on this article.

Thanks for studying

Michelle x

[ad_2]