There are two main ways a company can distribute money. The dividend is usually preferred by income-oriented investors. It is generally a cash payout. The second important way is to buy back and cancel your own shares. A phenomenon that is also known by the English term buyback.

When a company buys its own shares, on balance there is no change in the company’s earnings power. The turnover remains the same, as does the net profit. What does happen is that the capital structure of the company changes. The purchase of shares is usually done with liquid assets and this pushes the amount of cash down. This results in a decrease in equity.

If the purchase is not financed with cash, the company will have to borrow the money, which will result in an increase in the outstanding debt. Although there is a deterioration of the capital structure in both cases, the financial basis (debt ratio) of the company weakens the most when the money for share buybacks comes from its own resources.

Buybacks popular

The purchase of own shares is especially popular in the United States. Companies of all sizes and in almost all sectors buy their own shares. US companies typically spend 25-30% of their cash position on buybacks. For European companies that percentage is 5 to 6.

The purchase of own shares has pros and cons. Advocates of buybacks argue that they are more tax-efficient than dividends from a tax perspective. The purchase of own shares is not taxed, but profit distributions are.

Buybacks are also a more flexible way to pay out money than dividends. Investors react more negatively to a dividend suspension than to the halting of a share buyback program. Everyone knows where they stand with the dividend. Rather, it is a permanent obligation to shareholders.

Financial doping

But regardless of the fact that buybacks are less transparent, until recently the costs of the purchase were the major objection to the repurchase of own shares. Typically, buybacks are financed from cash and this pushes down the amount of cash on hand. The result is a decrease in equity and less money for business investments.

Opponents also argue that companies can use buybacks to meet performance targets tied to stock price growth. A company could limit its business investments or borrow heavily to finance the purchase of its own shares. In the extreme case, the top of the company uses the share buyback program as financial doping to safeguard the share price.

Timing is also a concern. Studies show that companies are particularly in the habit of buying back shares at the top of the market, when they are expensive. Instead of at the bottom, when they are cheap.

Controversial

Buybacks are also controversial in politics. Instead of investing, companies buy back their profits on shares to reward their top managers. Fueled by the coronavirus pandemic and the aftermath of Russia’s war in Ukraine, the US government is subjecting buybacks to a 1% tax starting this year. It remains to be seen whether that will have an effect.

It is expected that this tax will be further increased in the coming years. This makes the purchase of own shares less attractive. A tax rate of 2.5% would reportedly be enough to trigger a significant shift in spending from buybacks towards dividends.

Boost from buybacks

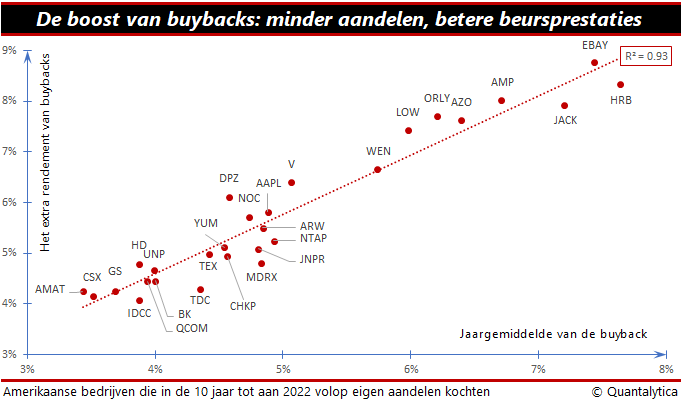

There are also calls in Europe to discourage the purchase of own shares. The fact is that buybacks translate, on average, into better stock market performance. The boost from share purchases on stock prices will be smaller due to a tax on buybacks, but will not disappear completely.