News item | 25-03-2021 | 4:35 pm

The bill introducing an additional withholding tax on dividend flows to low-tax countries as of 2024 was submitted to the House of Representatives today.

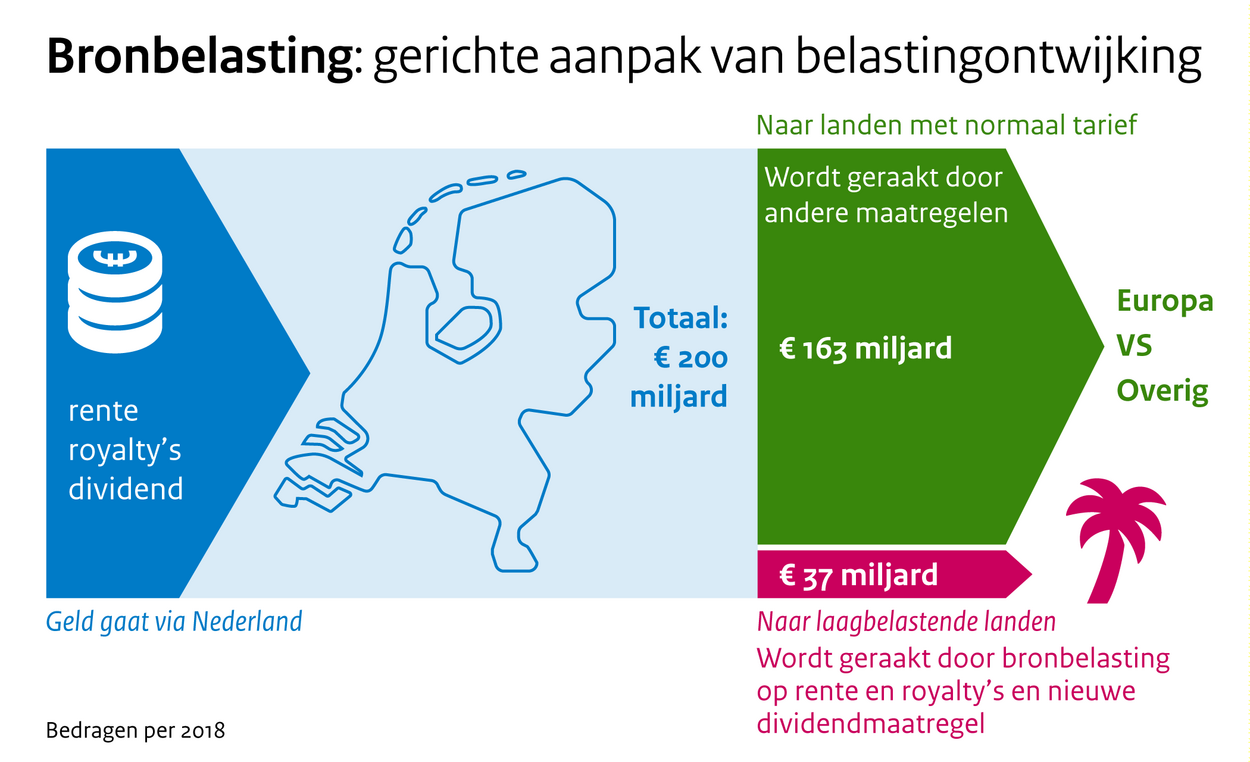

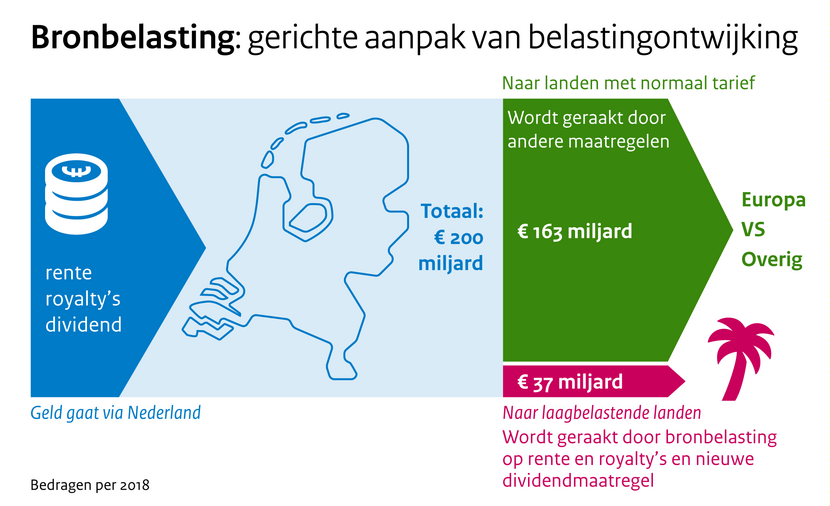

With the additional withholding tax, dividend payments to countries that levy no or too little tax are taxed by the Netherlands. The measures will apply to dividend flows to countries with a profit tax rate of less than 9% and countries that are on the European list of non-cooperative jurisdictions for tax purposes.

State Secretary Vijlbrief of Finance: “During this government’s term of office, the Netherlands has made a major U-turn when it comes to tackling tax avoidance. The withholding tax on interest and royalties is one of these most important measures. This withholding tax will also apply to dividends. Money flows that run through or from our country to another country where they are not taxed will become this. Now it is important to make even better international agreements on this, so that tax cannot still be evaded via other countries. The Netherlands can play a leading role here in the coming years.”

The withholding tax is in addition to the withholding tax on interest and royalties that came into effect on January 1, 2021. The bill that has now been sent to the House is designed in the same way. The measure will take effect in 2024, so that the Tax and Customs Administration has sufficient time to prepare.

The measures target a money flow to low-tax countries in a very targeted manner. In 2018, DNB estimated this amount at EUR 37 billion. The government expects that with this bill there will no longer be any dividend flows from the Netherlands to countries with a low tax rate. Therefore, no yield has been estimated.

Enlarge image

monitoring

Income flows from the Netherlands to low-tax countries are monitored annually. In 2023, on the basis of this, an initial measurement of the effect of the withholding tax on interest and royalties can be made.

The withholding tax is one of the many different measures that this government has taken against tax avoidance. You can read a complete overview here