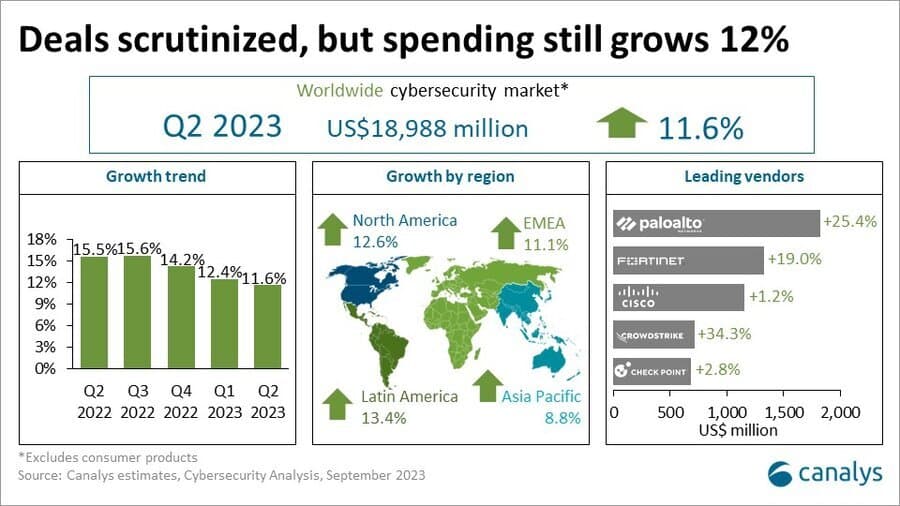

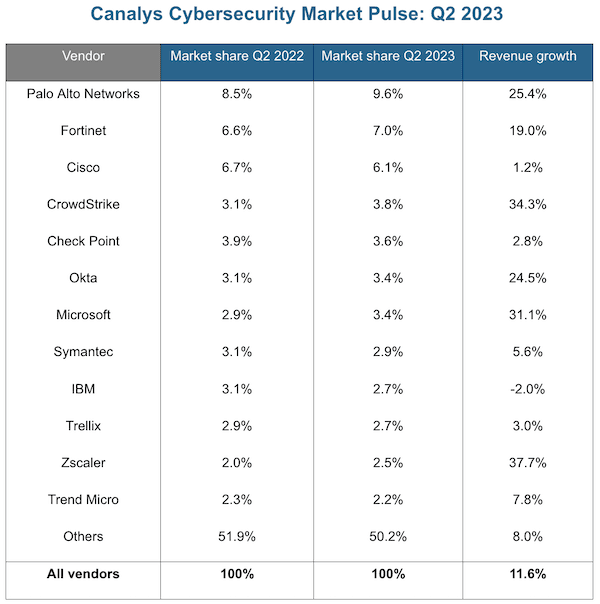

This is evident from figures shared by market researcher Canalys. The top 12 suppliers accounted for almost half of the spend in the market. Palo Alto Networks led the market in the second quarter, growing 25.4%, fueled by demand for SASE, SecOps and cloud security. Fortinet is in second place, benefiting from further gains in network security. However, the 19.0% growth in the second quarter is a slowdown from the 26.2% growth in the first quarter.

Cisco accounts for 6.1% of total spending, up from 6.7% last year. The company is under new leadership, with new platform launches and more acquisitions, including the intention to acquire Splunk for $28 billion. CrowdStrike, Check Point, Okta and Microsoft round out the top seven.

‘Unprecedented threat levels’

“Threat levels are at unprecedented levels, with publicly reported ransomware attacks increasing by more than 50% in the first eight months of this year and breaches of data records more than doubling. At the current pace, 2023 will be the worst year on record and well above the levels of 2021, when ransomware came to the fore following a series of high-profile events,” said Matthew Ball, principal analyst at Canalys.

In the second quarter of 2023, total spending on cybersecurity technology through this channel accounted for 91.5%, compared to 90.5% in the same quarter a year ago.

‘Channel partners are needed more than ever’

Now more than ever, customers need channel partners with cybersecurity expertise to build cyber resilience. This is a key theme at the Canalys Forums 2023. During the EMEA event in Barcelona, the threat landscape and neutralizing attack surfaces were discussed in sessions. Also, a panel of CEOs from Proofpoint, SonicWall and Trend Micro highlighted the need for partners to build more service-oriented relationships with customers and collaborate more with specialists to expand capabilities in areas such as red teaming and MDR. The suppliers want to improve cooperation with each other, especially in the areas of integration and data sharing.

Next month, Canalys will hold more partner and supplier sessions at the Canalys Forum North America in Palm Springs (November 13 to 15) and in December at the Canalys Forum APAC in Bangkok.

“Discovering vulnerabilities and building inventories of assets, and categorizing them based on risk level, is critical to prioritizing protection investments. This is also an important foundation for partners to build customer recovery plans in the event of attacks,” Ball said. “The cybersecurity services opportunity for partners will outpace cybersecurity technology sales this year, with spending expected to grow 13.2% to $143.2 billion by 2023. Managed security services and integration services are the fastest growing areas. ”

On a regional basis, spending remains resilient in North America (+12.6%), EMEA (+11.1%) and Latin America (+13.4%). At the same time, growth rates in Asia Pacific slowed (+8.8%) as organizations reduced spending.