As part of the budget talks, the government has decided to make additional contributions from the banks again to close the gap in the budget. The non-deductibility of the bank tax was increased from 80% to 100% and an additional progressive bank tax was introduced to additionally hit the largest banks in our country.

During the past budget rounds, the government has already substantially increased the contributions from the banks several times. The question is how long can such policies continue? The sector makes an urgent appeal to the government to discuss how, in partnership with the banks, it wants to tackle the challenges of the future, such as the transition to a sustainable society, in order to improve our economic fabric and our prosperity. strengthen.

Savings taxed again

The measures taken are regrettable and especially incomprehensible for a government that has been boasting for months that it wants to increase returns for savers. The new decisions are yet another pure budget measure that affects ordinary retail banking and further taxes the same activity, namely saving, over and over again. A comparison with our neighboring countries shows that Belgian banks already paid significantly higher contributions and charges on regular deposits.

This measure once again affects the banks’ ability to provide loans to companies and households and to fully play their role in the economy. Febelfin has stated from the start that it is up to the banks individually to properly assess their risks and see what return they can provide on savings deposits. An additional tax on savings deposits will now of course also have to be included in that analysis. This measure also affects the competitiveness of the Belgian financial sector in a European and international context.

The banking sector is already meeting the budget

In 2022, the banks paid a total of 3.61 billion euros in taxes, a significant financial contribution to the government. In addition to the ‘classic’ taxes and levies (corporate tax (1.10 billion euros in 2022), social contributions (855 million euros), etc.), the Belgian financial sector annually pays a number of specific levies to which other sectors are not subject, including the Annual Tax on Credit Institutions (JTK, 13.2 basis points), the DGS contribution (10.5 basis points) and the contribution to the resolution fund (SRF, 10 basis points). Good for a total of approximately 1.7 billion euros in 2022.

These contributions, with the exception of the SRFcontribution, all flow directly to the budget. The DGS contributions paid by the banks, which should serve to protect savings, and for which other European countries have set up a separate fund, also serve to feed the budget in Belgium.

These contributions will increase for this and subsequent years due to a number of measures that the government already decided last year and this year. After all, the banking sector was also examined during the previous budget round in October 2022 and the deductibility of the banking tax was limited. And the DGS contribution was also increased to 1.8% of the covered deposits. An unprecedentedly high percentage compared to other European countries, where the target figure is usually 0.8%.

And now once again the banks are allowed to close the budget, while the additional income from the restriction of the non-deductibility of the banking tax was not even awaited and evaluated. A measure is therefore being adapted for which the initial income is not yet known and has more than likely been greatly underestimated. These contributions were previously estimated by the sector at EUR 140 million instead of the budget target of EUR 86 million, and will now increase further due to the decision to make them completely non-deductible.

By introducing the progressive bank levy, the government also wants to raise additional income for the budget from the largest financial institutions. A tax calculated purely on size, and not on profit, can be questioned. The government’s policy should not be aimed at keeping companies small, but at supporting those who are responsible for innovation and digitalization and who help make the transition to a sustainable society possible.

Short-term vision limits social role of banking sector

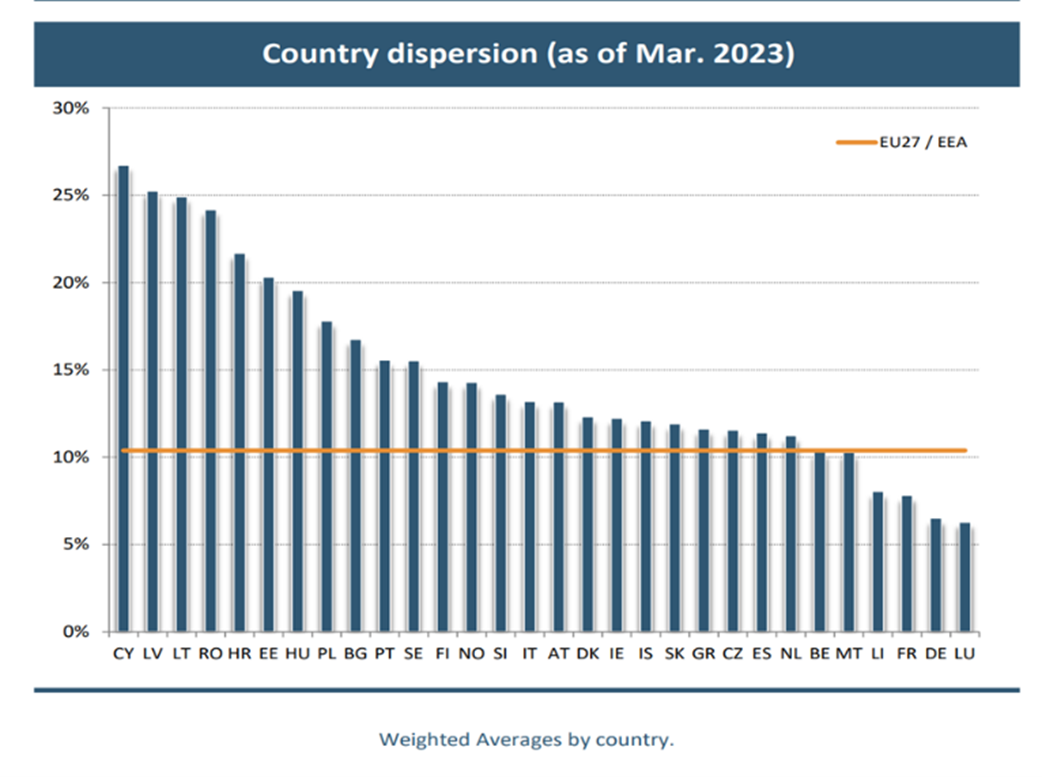

Many manifest untruths were also spread last weekend about the profits of the Belgian banking sector. The profits of Belgian banks are no higher than the profitability of banks in other European countries. The Belgian banks score average and are actually in the second half of the European peloton.

EBA Dashboard Q1 2023: RoE of Belgian banks not higher than the European average:

The profit figures are also in line with the minimum expectations of the ECB/SSM supervisor of the banks in terms of profitability, and are necessary to meet the many challenges and to absorb any future shocks or a deterioration in the economic situation. Moreover, profits are a timely data, a snapshot, while additional duties and taxes are permanently introduced.

Belgian banks will always continue to put customers, both private individuals and companies, and savers and borrowers, first. But the social role they want to play in supporting the Belgian economy is once again becoming more difficult. Complicated by a government that chooses to re-target the financial sector to feed the budget, instead of jointly developing a sound vision and measures that will benefit the Belgian economy, support for a sustainable society and Brussels as a financial center in the long term. term would benefit.