[ad_1]

Rightmove have simply launched the newest date on the rental marketplace for Q3 of 2022.

Key Headlines:

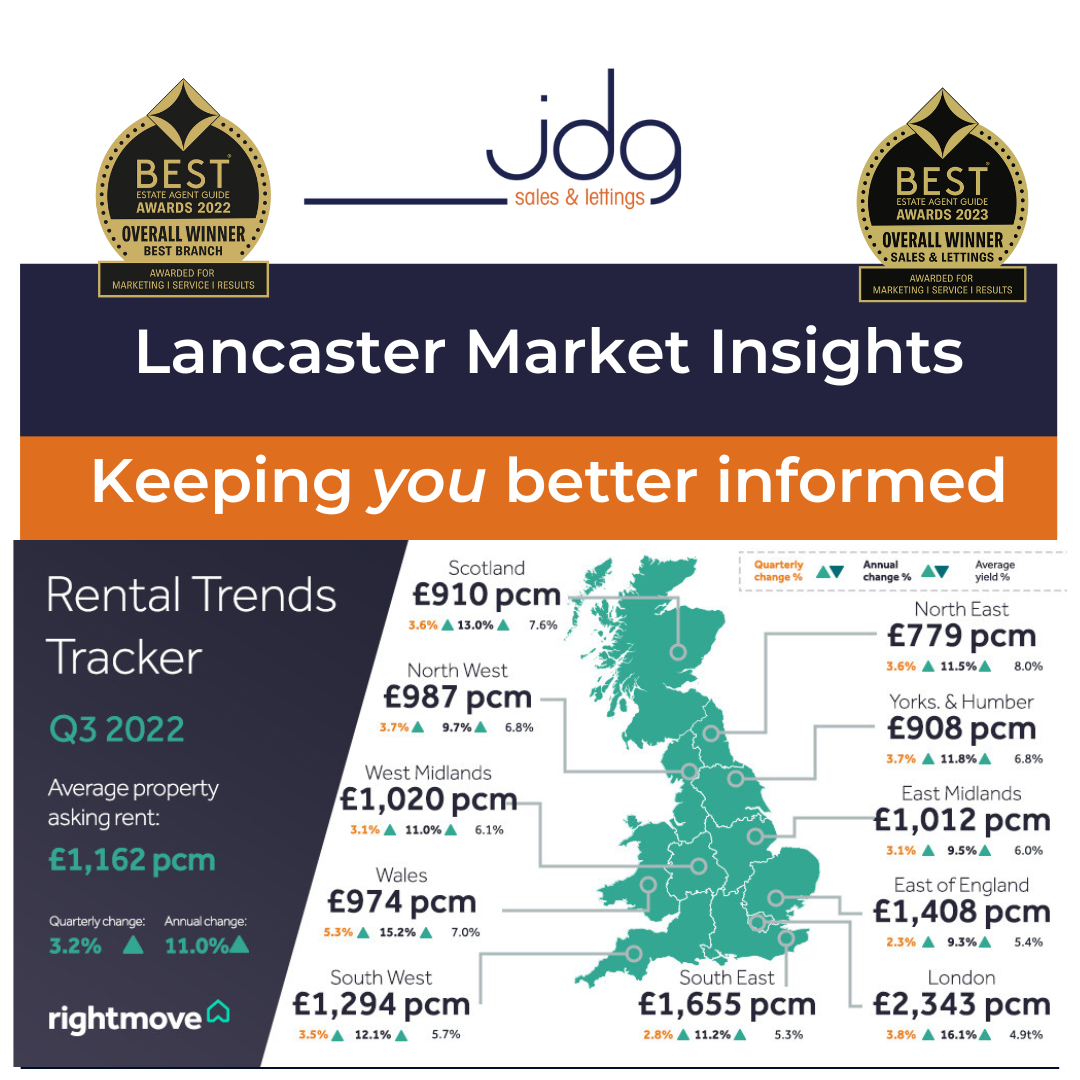

- Nationwide common asking rents exterior London have hit a brand new report, now £1,162 per calendar month (pcm):

- Asking rents leap by greater than 3% this quarter (+3.2%) for less than the third time on report

- Common London rents rise to £2,343 pcm, resulting in the most important ever annual leap of 16.1%

- Extra new rental properties can be found in each area besides London, easing among the strain on provide in some areas, nonetheless demand nonetheless tremendously outweighs the variety of properties out there to hire:

- Tenant demand is up 20% in contrast with final 12 months, and out there properties to hire is down 9%

- Competitors amongst tenants to safe a property is at a report excessive

- Soar in mortgage charges for brand new first-time patrons may imply some aspiring patrons keep renting for longer, which is able to place additional pressure on the variety of out there properties

- Studio flats have overtaken one-beds as probably the most in-demand flat kind for renters, with brokers suggesting stretched budgets and the returning recognition of metropolis centres are contributing to the shift: There at the moment are 4 occasions as many tenants searching for a studio flat as there are studio flats out there, a 71% improve on a 12 months in the past

Overview

Common asking rents for brand new tenants exterior of London have risen to a brand new report of £1,162 per calendar month. This quarter’s improve of three.2% is simply the third time on report that rents have elevated by 3% or extra in 1 / 4, as new asking rents proceed to rise quickly.

In London, common asking rents rise to a report of £2,343 pcm this quarter. This places the annual fee of asking hire development within the capital at 16.1%, the best yearly fee of development of any area on report.

The tempo of asking hire development is primarily all the way down to the extreme scarcity of obtainable rental properties, mixed with extraordinarily excessive demand which continues to surpass even final 12 months’s ranges in each area and nation of Nice Britain.

Demand is up by 20% in contrast with final 12 months, whereas the entire variety of out there properties to hire is down by 9%. This widening hole between provide and demand is creating ever fiercer competitors between tenants searching for a house.

In London, the variety of new properties changing into out there to hire is down by 24% on final 12 months, whereas each different area and nation in Nice Britain has seen a leap in new properties to hire, most importantly within the South West (+19%), Yorkshire & The Humber (+12%) and Wales (+10%).

There may be some strategy to go to slender the hole between provide and demand sufficient to regular new asking rents, nonetheless it does not less than give tenants in lots of areas some extra selection in contrast with final 12 months, although they’re very prone to nonetheless be competing for the property with many different renters.

Latest mortgage rate of interest rises implies that even with report rents, the common month-to-month mortgage fee for a brand new first-time purchaser placing down a ten% deposit is now a fifth (20%) greater than the rental fee for the equal kind of property – £1,121 pcm for the mortgage fee in contrast with £932 pcm to hire.

A knock-on impact of the rise in mortgage rates of interest might be that some first-time patrons who can now not afford the property they needed, or have determined to attend to try to get a clearer view of the market, might determine to increase their tenancy.

This may place added strain on the demand for residences and smaller properties to hire, at a time when demand for smaller properties to hire is already particularly excessive. Studio flats have overtaken one-beds as probably the most in-demand kind of flat for renters.

Studio flats had been sometimes extra in demand within the years main as much as the pandemic, nonetheless they had been overtaken by one-beds when the market reopened in Could 2020 and metropolis dwelling briefly turned much less widespread.

Competitors between tenants for out there studios is 71% greater than it was final 12 months and there at the moment are 4 occasions as many tenants searching for a studio flat as there are studio flats out there.

Brokers recommend that stretched budgets and the returning recognition of metropolis centres are contributing to the shift, as extra tenants search for the most cost effective property out there with out giving up town centre location, as a substitute of doubtless getting extra for his or her hire additional out.

Rightmove’s Director of Property Science Tim Bannister stated: “It’s an actual problem for renters for the time being, as there are merely not sufficient properties out there to hire to satisfy the demand from folks enquiring. While it’s optimistic information that the majority areas are seeing extra properties coming to market, with London the notable exception, finally the hole between provide and demand is changing into wider throughout the board. We are going to want a big addition of properties to come back onto the market to even start to steadiness the scales. These trying to hire a smaller property within the subsequent few months might discover that they face some added competitors from would-be first-time patrons, who’ve had their buy plans scuppered for now

as a result of sudden rise in mortgage rates of interest, and at the moment are trying to hire.”

Brokers’ Views

John O’Malley, CEO at Pacitti Jones in Glasgow, stated: “The will to return to town centre has by no means been extra obvious and the exceptionally excessive demand we now expertise for properties in these areas is living proof. In essence youthful professionals need the identical issues as they at all times needed – to exit and have a superb time – and this implies being again within the coronary heart of our cities and having fun with the social facilities out there.

“It’s not simply the youthful technology trying to reside in vibrant metropolis centre areas. The dramatic rise in the price of dwelling implies that we at the moment are beginning to see older folks downsizing to flats to cut back family payments – and being centrally situated they may also cut back journey bills. And that is one thing we count on to see extra of.”

Tim Hassell, Director at Draker Lettings in London stated: “Because the summer time market involves an finish, we’ve seen a big improve within the variety of tenants competing for a brand new property as quickly because it involves the market.

“Inside just a few hours of a property going reside, we’re receiving dozens of enquiries which, when in comparison with the pre Covid market, is excessive. Beforehand we might obtain between 5-10 enquiries within the first 48 hours and now we’re receiving 30-40 in the identical time-frame. This has additionally resulted in a number of gives from tenants who’re competing by paying over the asking value and providing vital funds up entrance.”

As at all times, if you’re pondering of changing into a landlord or just need some extra recommendation on the native market, please get in contact on 01524 843322 or e-mail josh@jdg.co.uk

[ad_2]